LogiRénov Home Renovation Tax Credit

LogiRénov Home Renovation Tax Credit

Financial assistance to renovate your kitchen? It is possible and above all, real!

LOGIRÉNOV PROVIDES A NEW TAX CREDIT FOR HOMEOWNERS

The LogiRénov program is designed for all homeowners who wish to make improvements to their home. This new refundable tax credit has been implemented on a temporary basis to encourage individuals, be they owners or co-owners of a dwelling, to renovate their principal residence, expand it, adapt it to the special needs of a family member or convert it into an intergenerational home.

It is aimed at any particular owner or co-owner, who executed renovations in respect of its principal place of residence, provided that the construction was completed before January 2014 and that the residence is:

- a single-family home

- a pre-fabricated house or mobile home permanently secured in place

- a unit in a condominium building

- a dwelling in a residential duplex or triplex.

The renovation work must have been done by a qualified contractors under a contract entered into after April 24, 2014, and before July 1, 2015. Individuals will have until 31 December 2015 to make and pay for their renovations.

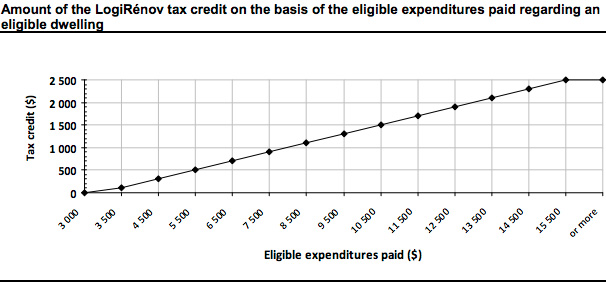

The financial assistance provided through this tax credit is for a maximum of $ 2,500 equal to 20% of the portion of eligible expenditures exceeding $ 3,000.

Important: You can claim the tax credit LogiRénov only for tax years 2014 and 2015, when filing your tax return.

To access the list of Renovation Work Recognized

http://www.revenuquebec.ca/fr/citoyen/credits/logirenov/liste-travaux-reconnus.aspx

For information regarding the LogiRénov tax credit for our customers in the greater Montreal region, you can contact Revenu Québec by calling 514 864-6299.

For more information, click on the following link

http://www.finances.gouv.qc.ca/fr/index.asp